Nigeria Tax Reforms 2026: New Property Tax Rules You Must Know

By Lucky Ajayi

New Tax Rules for Your Property: What You Need to Know

Nigeria tax reforms 2026 are bringing major changes to the country’s tax laws, and if you own property, plan to buy, or work as a landlord, these updates will directly affect you. The government wants to improve the tax system and increase revenue for national development. While some changes might seem confusing at first, understanding them now can help you make smart decisions for your property investments.

This guide breaks down the most important Nigeria tax reforms 2026 for real estate in simple terms, focusing on what they mean for you, especially if you are in Abuja. We will cover the benefits, the major changes, and how to protect your investments.

The Good News for Homebuyers & Renters: Saving Money on Your Next Home!

Let’s start with positive updates! If you are looking to buy a residential property or rent one, there’s a change that could save you money.

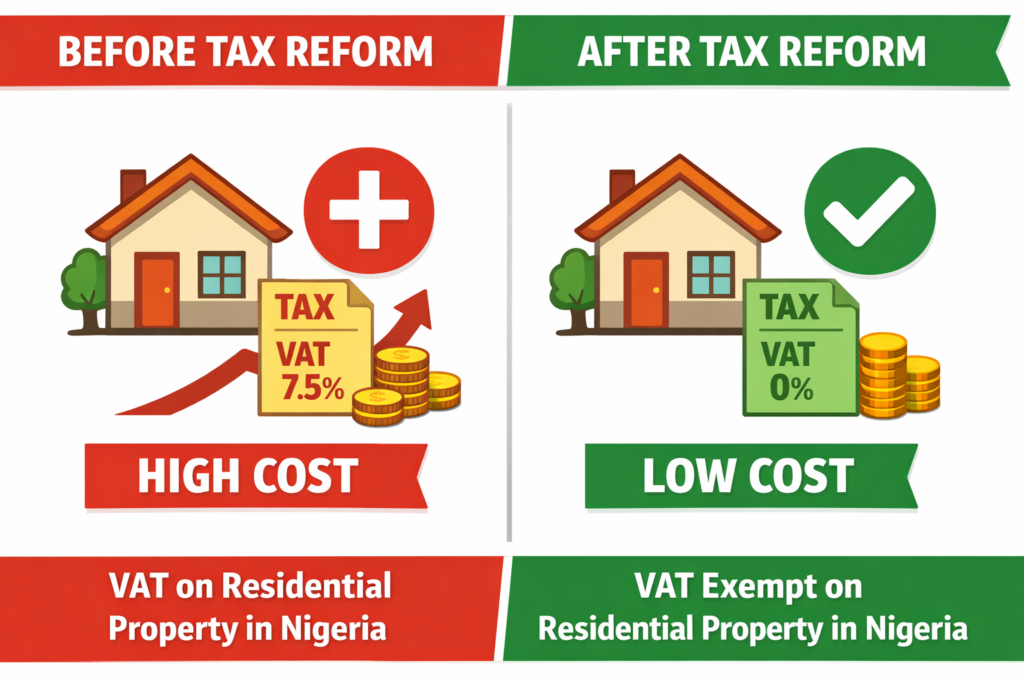

No More VAT on Residential Property!

Before, you might have paid a Value Added Tax (VAT) on some residential property transactions. But with the Nigeria tax reforms 2026 under the new Nigeria Tax Act 2025, buyers and tenants will no longer pay VAT on residential property deals [1] [2].

This is great because it means:

Lower Costs for Buyers: The overall cost of buying a home could be slightly less.

Easier for Tenants: Renting a home might also become simpler without this extra tax.

Help for Developers: Property developers can also recover the VAT they pay on building materials. This helps them save money, which can make housing more affordable in the long run.

This change aims to make housing more accessible for everyone across Nigeria.

The Big Changes for Investors & Sellers Under Nigeria Tax Reforms 2026

If you are an investor who buys and sells property to make a profit, or if you plan to sell a property you own, there’s a significant change you need to know about: Capital Gains Tax (CGT).

Higher Capital Gains Tax

CGT is a tax you pay on the profit you make when you sell an asset, like land or a building. The Nigeria tax reforms 2026 have increased this tax significantly:

- For companies, CGT has gone up from 10% to 30%

- For individuals, it is now between 15% and 25%

This means if you sell a property and make a profit, a larger portion of that profit will now go to taxes. This change will affect how investors value properties and how much profit they can expect to make from selling.

Luxury Property Owners: A New Tax is Here

If you own a high-end property in some of Nigeria’s most exclusive areas, there’s a new tax specifically for you under the Nigeria tax reforms 2026.

1.5% Annual Luxury Property Tax

The new reform introduces a 1.5% annual luxury property tax [2]. This tax will apply to expensive homes in prime locations such as:

Abuja: Maitama and Asokoro

Lagos: Banana Island and Ikoyi

This means if you own a luxury home in these areas, you will pay an extra 1.5% of its value in tax every year. This aims to make the tax system fairer by asking those with more expensive properties to contribute more. with more expensive properties to contribute more.

What About Landlords & Rent? How Nigeria Tax Reforms 2026 Affect Your Rental Income

Landlords and tenants also have some new rules to consider under the latest reforms.

Stamp Duties on Leases

If you have a lease agreement for more than ₦10 million, you will now pay higher stamp duties (a small tax on legal documents). However, smaller residential leases are still free from this increase [2].

Good News for Small Businesses!

If you are a landlord renting to small businesses, there’s a positive change. Businesses that earn less than ₦25 million a year can now deduct 20% of their rent from their taxable income [1]. This could make your property more attractive to small business tenants.

Your Next Steps: Expert Help with Nigeria Tax Reforms 2026

The Nigeria tax reforms 2026 show that the property market in Nigeria is becoming more complex. Trying to understand all these changes and make the best decisions by yourself can be very difficult and risky.

This is where Tabansi Consulting comes in. As expert Estate Surveyors and Valuers in Abuja, we understand these new tax laws and how they affect your property. We can help you:

✅ Understand the True Value: Get accurate valuations for your property under the new tax rules.

✅ Plan Your Investments: Create strategies on how to buy or sell property to reduce your tax burden.

✅ Ensure Compliance: Make sure all your property dealings follow the new laws to avoid problems.

Don’t let new tax rules catch you off guard. Contact Tabansi Consulting today to ensure your property investments are smart, safe, and fully compliant in 2026.

Learn More About Nigerian Tax Policy

For more information about tax regulations in Nigeria, visit the Federal Inland Revenue Service (FIRS) official website.

To understand property valuation standards, check the Nigerian Institution of Estate Surveyors and Valuers.today to ensure your property investments are smart, safe, and fully compliant in 2026.

References

[1] Policy alignment raises stakes for Nigeria’s housing sector. BusinessDay. https://businessday.ng/news/article/policy-alignment-raises-stakes-for-nigerias-housing-sector-in-2026/

[2] How Nigeria’s New Tax Law Will Reshape Real Estate Financing from 2026. NaijaHouses. https://www.naijahouses.com/news/news-view?slug=how-nigeria%E2%80%99s-new-tax-law-will-reshape-real-estate-financing-from-2026/

[3] Nigeria’s new tax law will stimulate real estate investments. Tribune Online. https://tribuneonlineng.com/nigerias-new-tax-law-will-stimulate-real-estate-investments-experts/