Real Estate Investment in Abuja: 5 Strategic Location is the Key to Success

Written by: Ajayi Lucky

The age-old adage in real estate has always been “location, location, location.” This principle remains as relevant today as ever, especially in dynamic and rapidly expanding markets like Abuja, Nigeria. Nigerian Bureau of Statistics (NBS), a reputable Nigerian business news site advised savvy investors seeking real estate investment success in Abuja, the physical position of a property is the single most critical factor, far outweighing the property’s physical characteristics, and significantly impacting its value, growth potential, and overall return on investment.

This comprehensive guide examines why location is the cornerstone of profitable real estate investments in Abuja and how strategic location selection can maximize your returns, transforming a simple purchase into a powerful wealth-building asset.

The Decisive Factors: How Location Determines Investment Value

The choice of location for real estate investment in Abuja is a decision that affects every aspect of your financial outcome, from immediate cash flow to long-term equity growth.

Property Value Appreciation: The Foundation of Wealth Building

Location serves as the primary driver of property value appreciation in real estate markets worldwide. In Abuja, Nigeria’s Federal Capital Territory, this effect is particularly pronounced due to the city’s rapid development and expansion. Properties situated in well-established neighborhoods or areas experiencing significant growth consistently outperform those in less strategic locations.

High-Performing Abuja Districts Share These Strategic Characteristics:

•Strategic Positioning: Proximity to the city center and commercial districts.

•Existing Infrastructure: Well-developed road networks, utilities, and public services.

•Prestige Factor: Social perception and status associated with these addresses.

•Development Potential: Room for continued improvement and expansion.

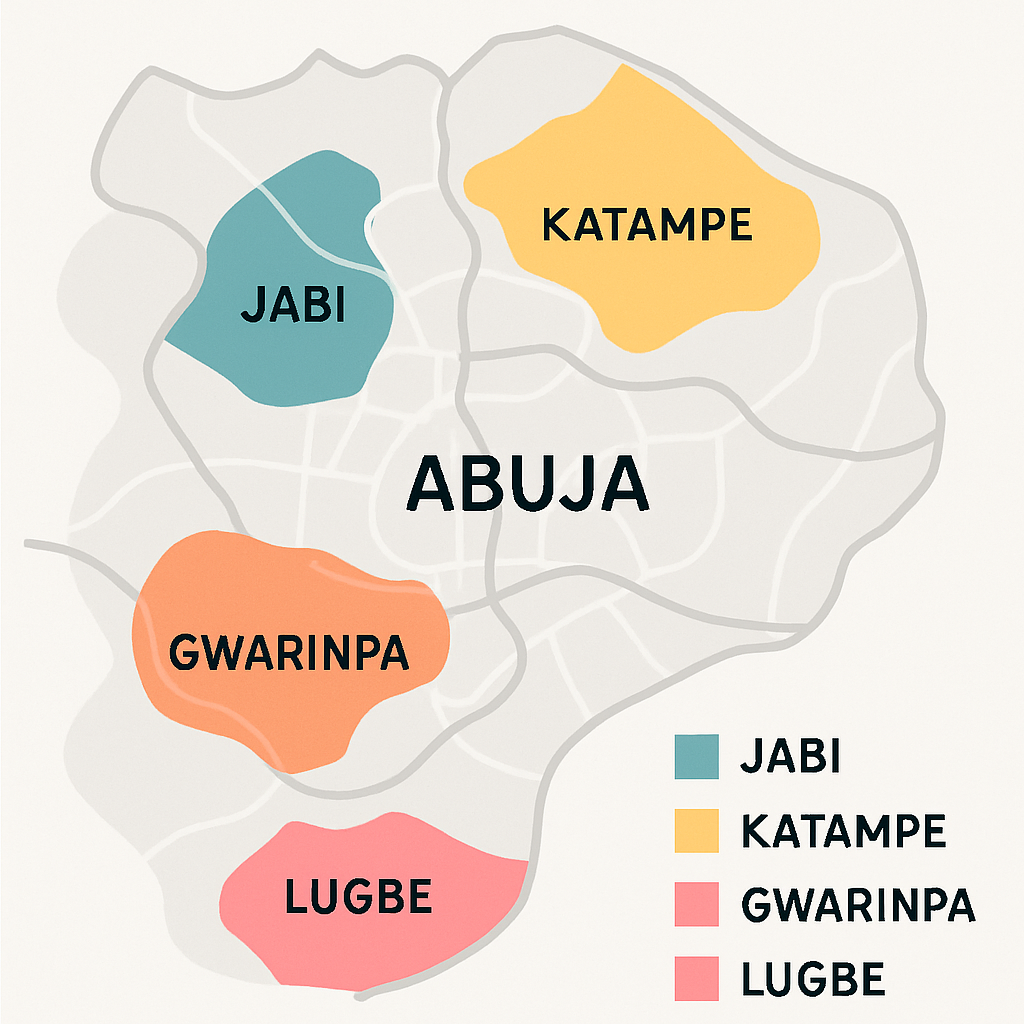

Districts such as Jabi, Katampe, Lifecamp, Wuse, and Guzape have demonstrated remarkable appreciation rates over recent years. This growth is no coincidence – these areas share common characteristics that make them highly desirable for real estate investment in Abuja. Investors who recognized the potential of these areas early have enjoyed substantial equity growth, sometimes seeing property values double or triple within 5-10 years.

Rental Income Potential: Creating Sustainable Cash Flow

Real estate investment in Abuja determinably tals about location, it dramatically influences not only its long-term appreciation but also its ability to generate consistent rental income. In vibrant urban centers like Abuja, rental yields can vary significantly based solely on location, with some areas commanding 30-40% higher rents than others just a few kilometers away.

Areas that Attract Strong Rental Demand Typically Share Several Key Characteristics:

•Proximity to Employment Centers: Properties near government offices, business districts, and commercial hubs attract professionals willing to pay premium rents for reduced commute times.

•Educational Institutions: Neighborhoods surrounding universities and quality schools draw families and students, ensuring consistent demand.

•Transportation Infrastructure: Easy access to major highways, public transportation, and the airport increases a property’s desirability.

•Lifestyle Amenities: Access to shopping centers, restaurants, entertainment venues, and recreational facilities enhances rental appeal.

Districts like Gwarinpa, Lokogoma, and Jabi exemplify this phenomenon in Abuja. These areas maintain high occupancy rates and command strong rental premiums due to their strategic positions and amenities.

Resale Value: Exit Strategy Considerations

Even the most dedicated long-term investors eventually face decisions about selling their properties. When that time comes, location becomes the determining factor in how quickly a property sells and at what price point. Properties in premier Abuja locations like Maitama and Asokoro typically sell faster and closer to asking price than comparable properties in less desirable areas.

Market data consistently shows that properties in prime locations:

•Spend 40-60% less time on the market before receiving acceptable offers.

•Experience less price negotiation and fewer concessions to buyers.

•Attract multiple interested parties, potentially driving prices above asking.

•Maintain their value better during market downturns.

Beyond Financial Returns: Lifestyle and Practical Considerations

While financial returns are paramount, the best location for real estate investment in Abuja also satisfies practical and lifestyle needs, which in turn, drive demand and value.

Quality of Life: The Everyday Experience Factor

Location determines the daily living experience of property occupants. In Abuja’s competitive rental market, properties that enhance quality of life command premium rates and attract higher-quality, longer-term tenants. Key quality of life factors include commute times, environmental quality, community atmosphere, and service accessibility. Areas like Jabi, Garki, and Utako exemplify this balance in Abuja, offering modern conveniences within walking distance or short drives.

Infrastructure Development: The Growth Catalyst

Real estate investment in Abuja delves in to Infrastructure development which serves as both an indicator and driver of location value. Areas receiving government and private sector infrastructure investments typically experience accelerated appreciation and demand. Critical infrastructure elements that boost property values include transportation networks, utilities and services, public facilities, and commercial development. Areas like Lugbe and Galadimawa demonstrate how infrastructure improvements transform property markets, making them prime targets for real estate investment in Abuja

Security and Safety: Non-Negotiable Requirements

In any real estate market, security concerns significantly impact property values and desirability. This factor is particularly pronounced in developing urban centers like Abuja, where security infrastructure varies considerably between neighborhoods. Properties in secure environments command substantial premiums because security-conscious families and expatriate tenants prioritize safety above most other factors. Established districts like Asokoro, Maitama, and parts of Gwarinpa feature enhanced security measures.

Strategic Location Selection: A Systematic Approach

Successful real estate investment in Abuja requires a systematic approach to location analysis, moving beyond surface-level observations.

Emerging vs. Established Areas: Risk-Return Considerations

Real estate investors face a fundamental choice when selecting a location for real estate investment in Abuja:

| Location Type | Advantages | Challenges & Risks |

| Established Premium | Lower risk, immediate rental income, proven appreciation history, stable tenant pools. | Higher initial capital required, lower potential growth percentages. |

| Emerging Areas | Higher potential percentage returns, lower entry costs, greater development upside. | Longer time horizons to profitability, higher risks of development delays, infrastructure uncertainty. |

Accessibility and Connectivity: The Lifelines of Property Value

Accessibility remains one of the most enduring determinants of location value. Properties with convenient access to transportation networks consistently outperform isolated assets. In Abuja, areas along major arteries like Airport Road and Kubwa Expressway have witnessed significant value increases due to their connectivity advantages. When evaluating potential investment locations, transportation infrastructure should receive primary consideration.

Practical Application: Making Location-Smart Investment Decisions

Thorough location research separates successful real estate investors in Abuja from those who struggle. A systematic approach to location analysis should include:

Due Diligence: Research Techniques for Location Analysis

•Historical Price Data Analysis: Review price trends over 5-10 years to identify growth patterns.

•Development Plan Review: Research government and private sector development initiatives.

•Infrastructure Assessment: Evaluate existing and planned transportation, utilities, and services.

•Demographic Analysis: Understand population growth, income levels, and tenant profiles.

•Rental Market Research: Analyze vacancy rates, rental yields, and tenant demand.

•Security Evaluation: Assess crime statistics and security infrastructure.

Future-Proofing: Anticipating Location Value Changes

The most sophisticated real estate investment in Abuja develop skills in anticipating how locations will evolve. Rather than simply analyzing current conditions, they identify indicators of future value shifts including: edge development, infrastructure announcements, commercial investments, demographic shifts, and regulatory changes.

Conclusion: The Unchangeable Factor in Abuja Real Estate

While property features, construction quality, and design all contribute to value, location remains the one factor that cannot be changed or improved through renovation. A beautifully designed property in a poor location will always struggle to achieve optimal returns, while even a basic property in a prime location maintains fundamental value.

For investors in Abuja’s dynamic market, location strategy must drive acquisition decisions. By prioritizing areas with strong appreciation potential, rental demand, infrastructure development, and quality of life features, investors can build portfolios that deliver both cash flow and long-term wealth accumulation. The most successful investors recognize that they are not merely buying properties – they are investing in locations whose inherent advantages will continue to drive value regardless of market cycles or economic conditions. This location-centric approach forms the foundation of sustainable real estate investment success in Abuja.

Frequently Asked Questions (FAQ)

Why is location considered the most important factor in real estate investment?

Location determines a property’s appreciation potential, rental income possibilities, resale value, and quality of life for occupants. Unlike property features that can be renovated or changed, location is permanent and influences nearly every aspect of investment performance.

Which areas in Abuja currently offer the best investment potential?

Established areas like Katampe, Lifecamp, Maitama, Asokoro, Wuse, Gwarinpa, and Jabi continue to perform well due to their infrastructure and prestige. Emerging areas showing strong potential include Lugbe, Kuje, Galadimawa, and Lokogoma, where infrastructure improvements are driving rapid appreciation.

How significantly does location affect property resale value?

Location is the primary determinant of resale value and marketability. Properties in desirable locations with good infrastructure, security, and amenities typically sell 30-50% faster and experience less price negotiation than similar properties in less advantageous locations.

What role does infrastructure play in determining location value?

Infrastructure creates the foundation for location value through accessibility, utilities, and services. Areas with reliable electricity, water supply, quality roads, and access to transportation consistently outperform those lacking these essentials. Future infrastructure plans are powerful indicators of appreciation potential.

Is it advisable to invest in developing outskirts areas of Abuja?

Investing in developing areas can be highly profitable when approached strategically. Areas like Karu, Kuje, and Dutse offer lower entry prices and significant appreciation potential as the city expands. However, these investments typically require longer time horizons and careful due diligence regarding development plans and infrastructure timelines.

How does neighborhood safety impact real estate investment returns?

Safety is a primary consideration for most tenants and buyers, directly affecting demand, rental rates, and property values. Secure neighborhoods command premium prices but deliver superior occupancy rates and tenant quality. Security infrastructure should be a key factor in location selection rather than an afterthought.

What should investors look for when evaluating an area’s appreciation potential?

Key indicators include proximity to existing high-value areas, planned infrastructure projects, commercial development initiatives, population growth patterns, employment center access, and government development priorities. The most promising locations typically combine several of these positive indicators. patterns, employment center access, and government development priorities. The most promising locations typically combine several of these positive indicators.

This is educative, i would need more info on this

nys5bj